Thank you DiversyFund for sponsoring this post. It’s never too early to learn about investing for your future!

Being a dad of 5 and grandfather of 2 isn't that bad. Matter of fact, it is one of the most enjoyable jobs I have ever had in my life.

It is amazing that I have been a part of 7 little people's lives from the start. I can't count the number of tickles and horse rides I have been a part of but loving on them is the easy part!

Let's talk about the tough job of being a father figure or someone that wants to be a positive role model.

One Dad to Another - Financially Invest

I would say I have a good pulse on the topic. Growing up, I witnessed my dad's struggles with work and financial stability. Granit, he wasn't a guy full of conversation, but when he spoke, I listened.

We spent a good amount of time in the garage tinkering on small projects, and in those times we talked about life, girls, and money.

He was/is a engineer for a North Texas manufacturer company, and loves what does. On many of times he would tell me to find a career that I would enjoy to do. That way making money would be fun, and not a "drag".

I try to instill that same philosophy in my family.

Invest Your Hard Earned Money

When I was growing up, my family struggled with money, I remember living pay check to pay check... just like my family now.

Along time ago, I remember asking my Grandpa "how or why do we have two houses?" His response was one I didn't understand then, but I do now. He explained that he invested a little bit of every paycheck in the stock market.

How Do You Grow Your Stock Portfolio?

Unfortunately, it has taken me a lot longer to figure it, but I am getting there.

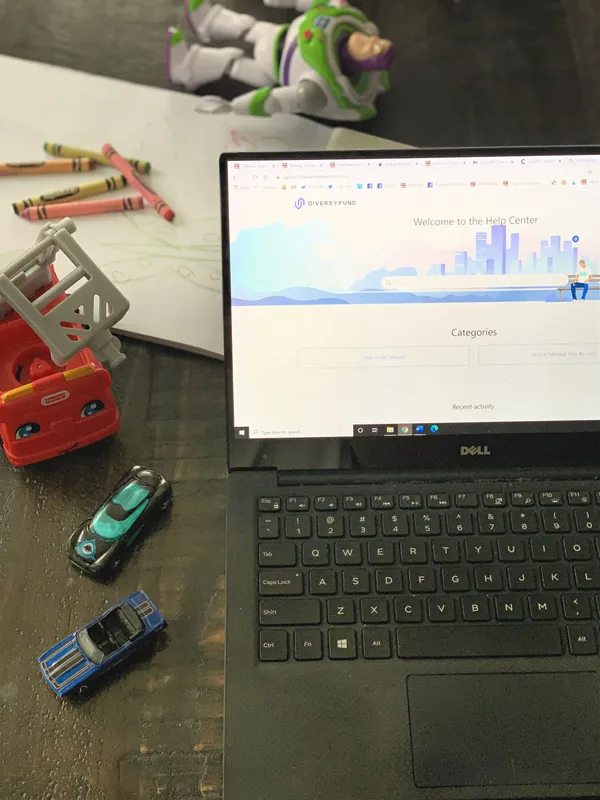

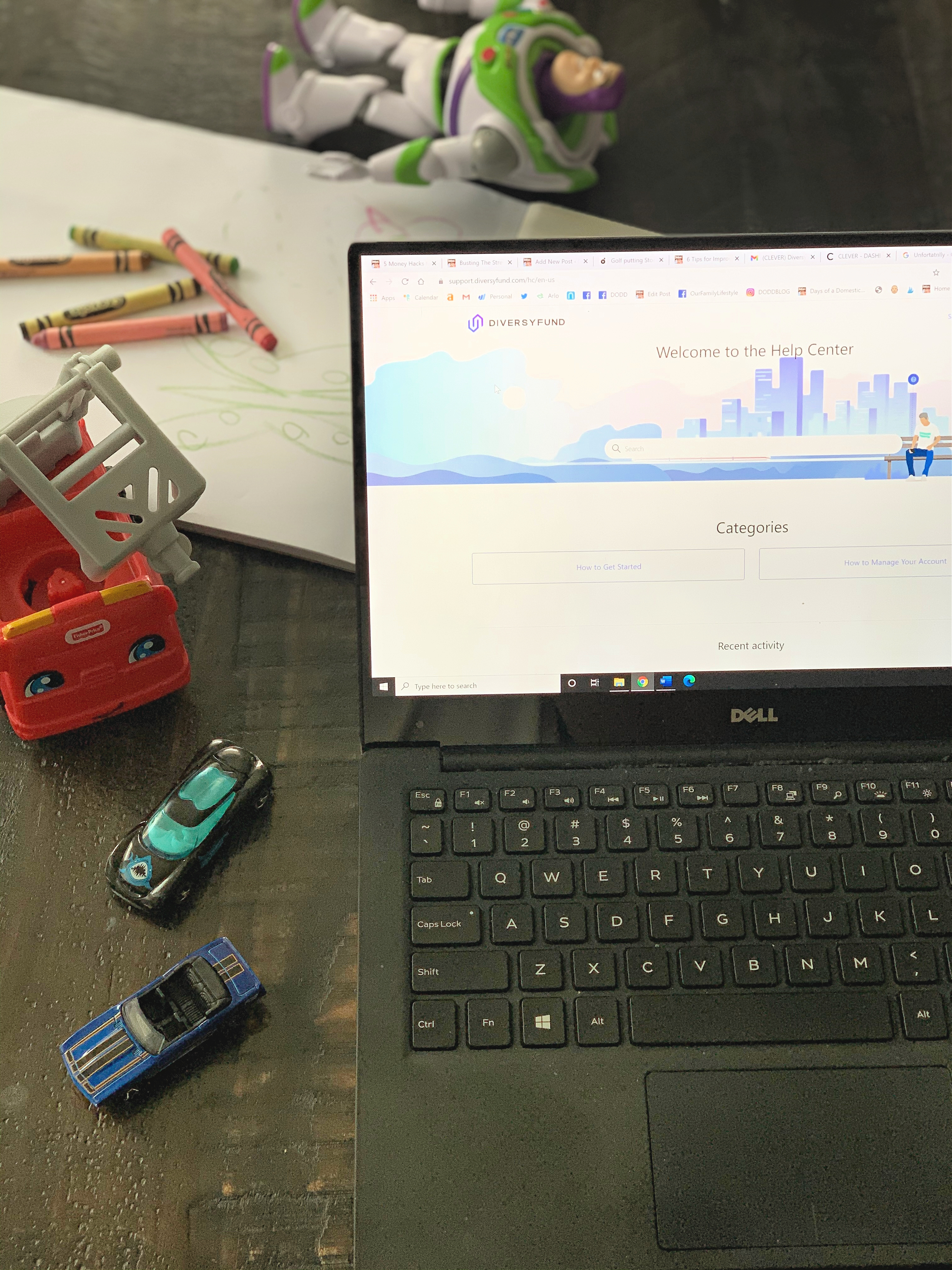

After careful research and referrals from friends, I have decided to take a hard look at Diversyfund.

Why I Like Diversyfund

- DiversyFund was founded on the belief that everyone deserves access to the same wealth-building tools that have long been used by the 1% to create and sustain generational wealth.

- DiversyFund empowers the everyday investor, with the ultimate goal of closing the wealth gap.

- The self-serve investment platform offers 24/7 access to DiversyFund’s unique offerings, including high value private real estate investment funds and financial educational services.

- Starting with a minimum investment of only $500 and no management fees, DiversyFund makes it possible for you to diversify your portfolio with one of the most attractive—and historically profitable—forms of alternative asset investment: multifamily commercial real estate through the DiversFund Growth REIT (real estate investment trust).

- DiversyFund is on a mission to empower the 99% to invest like the 1%

- DiversyFund operates a private real estate investment trust (REIT) that consists of projects and properties handpicked by a team of expert real estate investors. Those experts identify high-potential properties, buy them, then manage, renovate, and sell them to turn a profit. When they sell, they split the profits among all investors in the trusts, putting money back into your pocket.

Now I know that is a lot of info, and I can't say is the best program to invest. But, I can say, on "paper" they look trustworthy and promising.