Thank you, Capital One® for sponsoring this post! All opinions are my own and were not directed by Capital One. To learn more about CreditWise® from Capital One, visit: www.capitalone.com/creditwise

Today I want to talk about my #CreditResolution for 2017: raising my credit score. Why? We are hoping to buy a new home, and I know I need a better score to qualify for a better rate on a mortgage. It’s an ambitious goal but I’m ready to take it on – and with an app like the CreditWise app the process just got a whole lot more manageable.

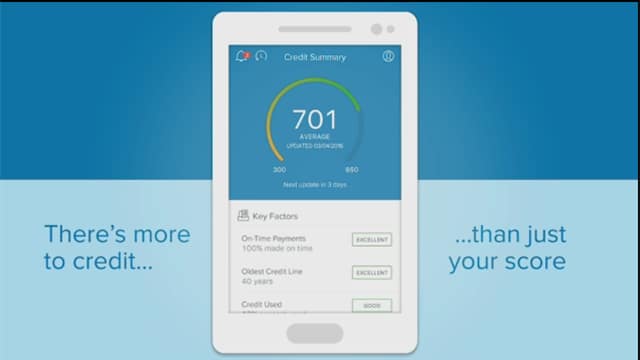

CreditWise App

There’s so much that goes into even the thought of buying a home, and I’ve recently started to get a little overwhelmed with all of the details I know I have to keep track of. Talking to banks, deciding on whether or not to use a realtor, saving for our down payment and then actually finding our perfect home – not to mention monitoring my credit so I can hopefully lock in a better rate. Guys, the struggle is real.

CreditWise is leading me in the right direction, and I find that it’s such an easy way to monitor and protect my credit. With the ability to track my credit score and learn ways to improve it, I know that I’m inching closer and closer to my ‘goal’ credit score – it’s a marathon, not a sprint.

Thinking about my #CreditResolution, I’m starting with the basics: paying my bills on time, increasing my minimum payment (better yet – paying in full whenever I can), and lowering the percentage of credit I use each month. I also plan to use CreditWise’s simulator to see what other small steps I can take to help give my score the boost it needs. For instance, I tried simulating how borrowing money for my future home would potentially impact my credit score and I was blown away by what I learned.

What I appreciate most about CreditWise app is that it’s 100% free and available to everyone, not just Capital One customers. If you’re an aspiring home buyer like me, it’s a must-have app so you can keep tabs on your credit score. It takes some of the pressure off because there is no “what if,” only “what could be.”

These small steps I’m taking toward improving my credit are affording me the confidence I need to manage my credit and take better control of my finances overall. This is meaningful for me as I look into home loans and get to the point where I’m finally applying for a mortgage – and even now as I work to pay down those holiday expenses.